BUSINESS SOLUTIONS

LOANS -TERM & REVOLVNG-AND MUCH MORE!

HISTORY - FACTS - #1

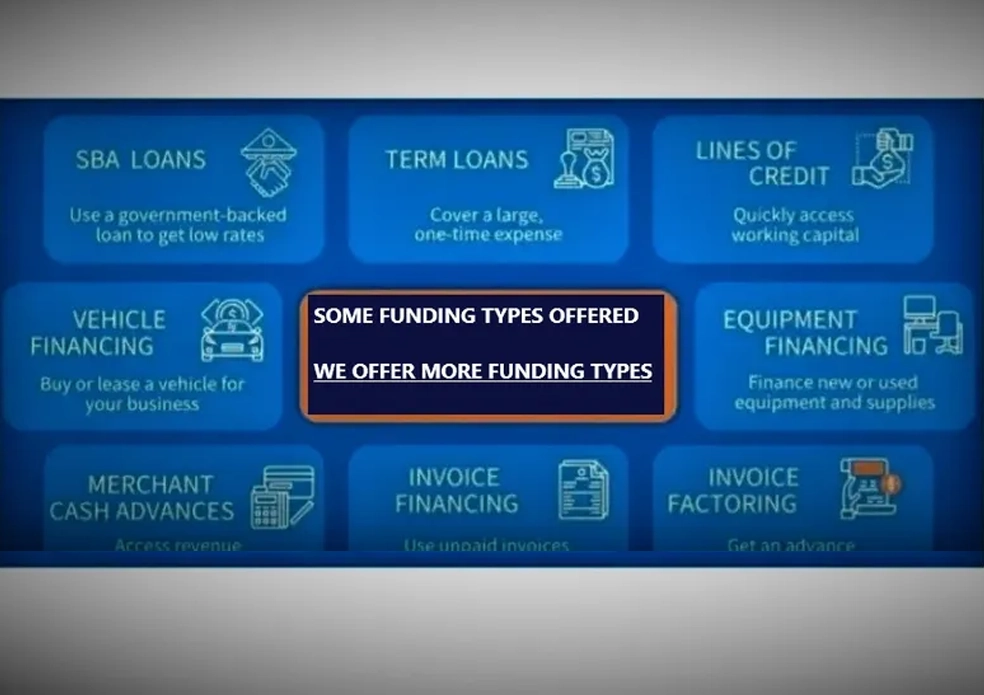

ASSOCIATED INVESTMENT COMPANY - SERVICES and its affiliates, is family-owned and operated since 1926. The company provides the highest level of personalized services by processes via broad ranges of funding sources.

- * TERM LOANS

- * REVOLVING LINES OF CREDIT

- * INSURANCE NEEDS

- * MERCHANT SOLUTIONS

- * BUSINESS TECHNOLOGY NEEDS

- * WEB & E-COMMERCE SOLUTIONS

- * PAYROLL & BENEFITS SOLUTIONS

- * HUMAN CAPITAL MANAGEMENT

- * FINANCIAL INSTITUIONS PARTNERSHIPS & SOLUTIONS

Our streamlined group of cash flow professionals specialize in cutting edge service striving to meet our clients diverse cash flow needs through efficient through proven processes via broad ranges of funding sources.

We are ALSO privileged to provide optimum services to meet your financial goals in successful funding’s by Venture Capital, Investment Houses, Investors, Non-Banks, Select Banks, Specialty Lenders, Hedge Funds and other Non-Traditional Financial Sources for your Real Estate Needs, Equipment Needs, Working Capital, Account Receivable – Purchase Order –Inventory Financing, Business Start-Up(s), Oil and Gas Wells and many other projects and business needs all over the world. In addition, we have arrangements with many traditional lenders to guarantee you the most competitive business loans, mortgage products, other financial instruments or leases available.

CREATIVE - FACTS - #2

Unlike traditional banks, our real estate specialists focus on access to real estate investment capital. Together WITH Business Cycle Corporate Management Services, our staff has over 100 years of experience in real estate and corporate lending AND PERSONAL MORTGAGE NEEDS. Our success is built on our ability to provide professional financing services to fit your individual needs. We are committed to the development of lucrative business relationships through the funding of complex needs.

WE MAKE FUNDING YOUR BUSINESS EASIER

- Our financing specialists provide white-glove service, and will walk you through the entire process. No navigating complicated forms or documents on your own.

- We provide financial solutions — not loan products. This means that we’ll assess your actual business needs to come up with the best financing solution, whether if that’s a line of credit or a term loan, or a blended solution that meets both long and short term funding needs.

- As a complete business solutions provider, we can help you maximize your funding by helping your business find areas to grow your business, cut costs, and minimize risk.

BUSINESS CYCLE CORPORATE MANAGEMENT - FACTS - #3

We offer Business Cycle Corporate Management Services to strategically guide and grow businesses and profitability of the businesses through cycles business usually experience.

Business cycles are cycles of fluctuations in a businesses Gross Domestic Product (GDP) around its long-term natural growth rate. It explains the expansion and contraction in economic activity which businesses and the economy experiences over time.

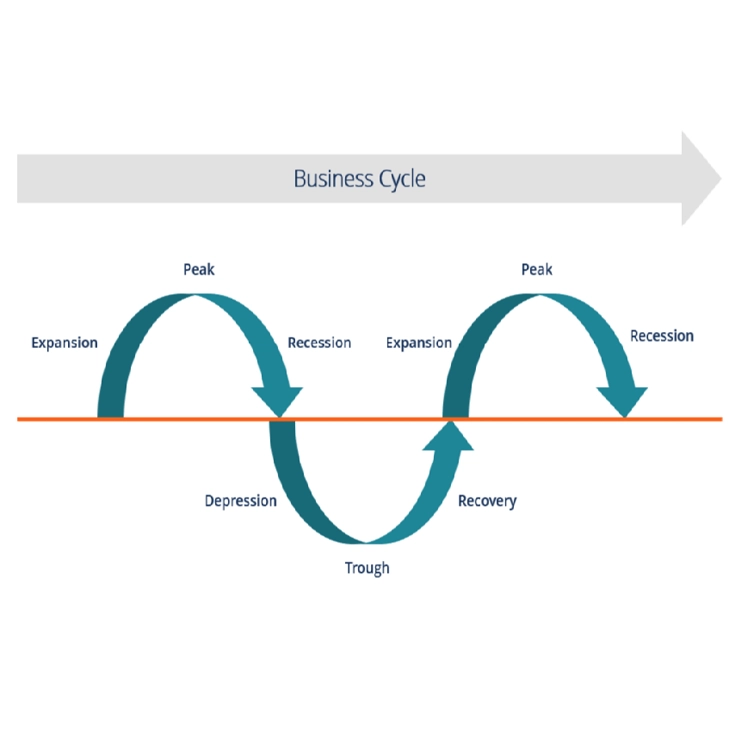

Business Cycle DiagramA business cycle is completed when it goes through a single boom and a single contraction in sequence. The time period to complete this sequence is called the length of the business cycle. A boom is characterized by a period of rapid economic growth whereas a period of relatively stagnated economic growth is a recession. These are measured in terms of the growth of the real GDP, which is inflation-adjusted.

Stages of the Business Cycle

In the diagram above, the straight line in the middle is the steady growth line. The business cycle moves about the line. Below is a more detailed description of each stage in the business cycle:

1. Expansion

The first stage in the business cycle is expansion. In this stage, there is an increase in positive economic indicators such as employment, income, output, wages, profits, demand, and supply of goods and services. Debtors are generally paying their debts on time, the velocity of the money supply is high, and investment is high. This process continues as long as economic conditions are favorable for expansion.

2. Peak

The economy then reaches a saturation point, or peak, which is the second stage of the business cycle. The maximum limit of growth is attained. The economic indicators do not grow further and are at their highest. Prices are at their peak. This stage marks the reversal point in the trend of economic growth. Consumers tend to restructure their budgets at this point.

3. Recession

The recession is the stage that follows the peak phase. The demand for goods and services starts declining rapidly and steadily in this phase. Producers do not notice the decrease in demand instantly and go on producing, which creates a situation of excess supply in the market. Prices tend to fall. All positive economic indicators such as income, output, wages, etc., consequently start to fall.

4. Depression

There is a commensurate rise in unemployment. The growth in the economy continues to decline, and as this falls below the steady growth line, the stage is called a depression.

5. Trough

In the depression stage, the economy’s growth rate becomes negative. There is further decline until the prices of factors, as well as the demand and supply of goods and services, contract to reach their lowest point. The economy eventually reaches the trough. It is the negative saturation point for an economy. There is extensive depletion of national income and expenditure.

6. Recovery

After the trough, the economy moves to the stage of recovery. In this phase, there is a turnaround in the economy, and it begins to recover from the negative growth rate. Demand starts to pick up due to low prices and, consequently, supply begins to increase. The population develops a positive attitude towards investment and employment and production starts increasing.

Employment begins to rise and, due to accumulated cash balances with the bankers, lending also shows positive signals. In this phase, depreciated capital is replaced, leading to new investments in the production process. Recovery continues until the economy returns to steady growth levels.

This completes one full business cycle of boom and contraction. The extreme points are the peak and the trough.

ABOUT US

BUSINESS CYCLES CORPORATE MANAGEMENT SERVICES

We have years of experience helping clients prepare for end result business profits, overall ups and prevent monthly downs & for the unknown while meeting their financial goals. Ask us about our services offered. You will be glad you did as will we be grateful!

As an independent financial services firm, we can access many different Loans and Loan Solutions so you can get the right Loans.

In addition, we offer you growth and profitability and productivity through our Business Cycle Management along with Financial Services.

Comprehensive Approach

We use proven finance strategies designed to meet your risk tolerance and stand up against market volatility. And you can count on unbiased recommendations and impartial guidance and management services based directly on your needs and goals.

Committed to Service

Every successful financial strategy starts with an excellent client relationship. Our mission and values include exceeding our client’s every expectation. Call us today to find out how we can suggest long- and short-term strategies that will help you realize your financial dreams.

ASSOCIATED INVESTMENT COMPANY BLOG

All Posts Blog - Associated Investment

REVIEWS

FREQUENTLY ASKED QUESTIONS

Please reach us at [email protected] if you cannot find an answer to your question.

ONLINE APPOINTMENT SCHEDULE REQUESTS

All Services ONLINE APPOINTMENT SCHEDULE SERVICE

CONTACT US

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Get Started Today

Reach out with any questions or to set up a meeting to discover the best path to your financial freedom!

Associated Investment Company - Financial Services

Hours

- Monday - Friday: 10am - 5pm

- Saturday: By appointment

- Sunday: Closed